Do CDS Make Banks Safer? Evidence from COVID-19

Do CDS Make Banks Safer? Evidence from COVID-19

MATT BRIGIDA

Associate Professor of Finance (SUNY Polytechnic Institute)

Result

We find evidence that Credit Default Swap (CDS) purchases increase bank safety.

CDS

CDS are derivative contracts which act as bond insurance. They can be customized, but typically:

- If the underlying bond is not in default, the buyer makes regular payments to the seller.

- If the underlying bond defaults, the seller pays the par value of the bond to the buyer.

CDS trade off exchange, with investment banks making the market. Since contracts are privately negotiaged, there can be different features between contracts.

Literature

It may be the case that CDS purchases by banks are to speculate, and so CDS increase rather than decrease bank risk.

Guettler and Adam (2011) finds evidence that U.S. fixed-income mutual funds use CDS primarily to gain exposure to credit risk rather than hedge. These funds also underperform.

The use of a derivative contract to lessen a bank's risk may allow the bank to increase risk in another area.

Parlour (2013) investigate the trade-offs between selling a loan and buying CDS on the loan in order to reduce risk.

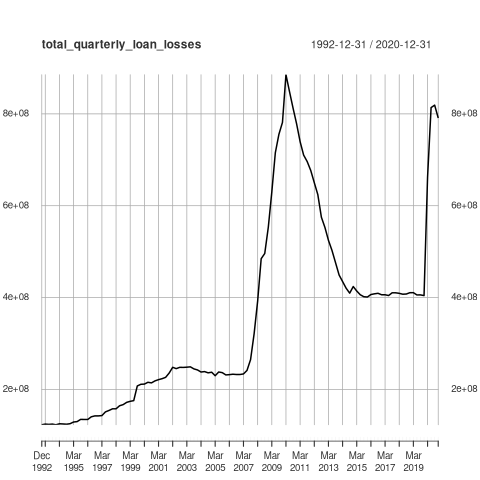

Data

The data set used in this analysis was built from the Federal Deposit Insurance Corporation's (FDIC) Statistics on Depository Institutions (https://www5.fdic.gov/sdi/index.asp) data repository.

- To calculate the percent change in loan loss reserves, we used the percent change in the "Loan Loss Allowance" (code:

lnatres) account from Q4 2019 to Q1 2020. - All explanatory variables are from Q4 2019.

Loan Loss Reserves

- Loan Loss Reserves is an contra asset account

- If the account is increased (on the balance sheet), then this is an expense on the income statement.

The mean Tier 1 Risk Based Capital Ratio for CDS buyers is significantly higher than for sellers.

Methods

- We estimate cross-section regressions with Heteroskedasticity robust standard errors.

- We estimate separate regression for (1) all banks, and banks with (2) and without (3) CDS.

Results

- The more CDS a bank owns, the lower the increase in loan loss reserves.

- The more CDS a bank sells, the greater the increase in loan loss reserves.

- Controls are consistent with the literature.

Conclusion

In response to the COVID crisis, banks markedly increased their loan loss provisions.

- We find banks which own more CDS had smaller increases in loan loss provisions, and vice versa.

- This evidence is consistent with banks using CDS to decrease the risk in their balance sheet.